公司动态

关于我们

公司动态

产业聚焦

可持续发展

海融云服

我要融资

招贤纳士

HAIER LEASING SOCIAL BOND FRAMEWORK May 2022

1. INTRODUCTION

1.1 About Haier Financial Services China Co., Ltd

Founded in December 2013, Haier Financial Services China Co., Ltd (the “Company” or “Haier Leasing”) is a national leading commercial leasing company, a member of Haier Group and a subsidiary of Haier Group (Qingdao) Jinying Holding Co., Ltd. The Company provides one-stop financial solutions by offering finance leases, commercial factoring, and a broad range of value-added services. In the meantime, it is also committed to diversifying its offerings to value chain players by integrating financial services, investments, advisory services, etc., to empower and create a sound ecosystem for the value chains. With the vision and mission of “Finance for Industries”, the Company has expanded its businesses to multiple industries including medical and health care, education, smart manufacturing, agriculture and food, and Medium, Small and Micro Enterprises (MSME) finance, with a commitment to building a robust ecosystem for the industries, creating a win-win relationship with its customers, and catalyzing the transformation, upgrade, and sustainable development of the industries.

1.2 Social Responsibility Commitment and Strategy

The Company proactively integrated Environmental, Social and Corporate Governance (“ESG”) factors into its business strategy and take “integration, balanced development, reduced poverty and inequalities” as its core responsibilities. By fully leveraging the synergy and resources from the collaborations with various industry partners and by resonating with the customers’ needs, the Company strives to identify and create values, and to share the innovations, achievements, and benefits with its customers. In the meantime, with the objective to promote the robust, sustainable, steady and harmonious development of the industrial economy and the whole society, the company established a communication mechanism to integrate the demands and interests of all stakeholders, including customers, employees, investors and the environment at large, into its operation and decision-making process.

Industries that address social needs, especially the underserved healthcare, education, and agriculture sectors, in China’s underdeveloped regions such as rural areas, have been prioritized in the Company’s business strategy. Meanwhile, the Company will strengthen financial support to MSMEs in underdeveloped regions such as counties in response to Chinese government’s call on “financial inclusion”,. Further, the Company also pays special attention to women entrepreneurship and employment to fulfill its social commitment in reduced inequalities.

1.3 Social Portfolio Management and Policy

The Company supports the Sustainable Development Goals (SDGs) and attaches great importance to the sustainable development of its clients and its own business operations. The company will establish an environmental and social risks management system per the Performance Standards of International Finance Corporation (IFC), a member of the World Bank Group, while following industry best practices. The use of proceeds from the Company’s Social Bond will contribute to the following SDGs:

- SDG 2 – Zero Hunger

End hunger, achieve food security and improved nutrition and promote sustainable agriculture

- SDG 3 - Good Health and Well-being

Ensure healthy lives and promote well-being for all at all ages

- SDG 4 – Quality Education

Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all

- SDG 5 - Gender Equality

Achieve gender equality and empower all women and girls

- SDG 8 - Decent Work and Economic Growth

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all

- SDG 10 – Reduced Inequalities

Reduce inequality within and among countries

The Company will continue expanding investments in industries that catalyze greater social benefits. In addition, the Company will adopt IFC’s Exclusion List in the selection of Social Bond eligible assets and will not finance any activities that will pose significant adverse impacts on the environment or society.

2. PURPOSE OF THIS FRAMEWORK

The Company has developed this Social Bond Framework (the "Framework") to raise funds for eligible projects that create positive social impact in the county regions of China. The Framework provides a set of clear and transparent standards that support investments that deliver significant social benefits and create long-term values for the Company’s stakeholders.

Haier Leasing’s Framework is aligned with the components of Social Bond Principles (2021), as administered by the International Capital Market Association, and addresses the following key pillars, in line with the SBP:

- Use of Proceeds

- Process for Project Evaluation and Selection

- Management of Proceeds

- Reporting

- External Review

Haier Leasing has appointed the independent Second Party Opinion (SPO) provider Sustainalytics to review the Social Bond Framework and attest to its alignment to the SBP and the relevant UN SDGs. Both the Framework and the SPO are publicly available on the official websites of Sustainalytics and the Company.

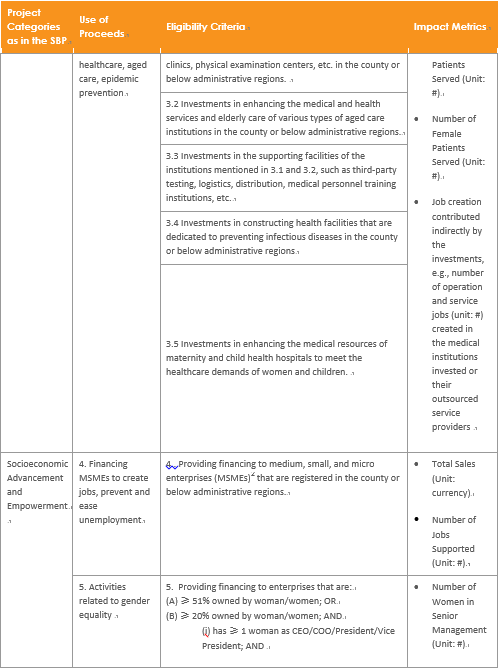

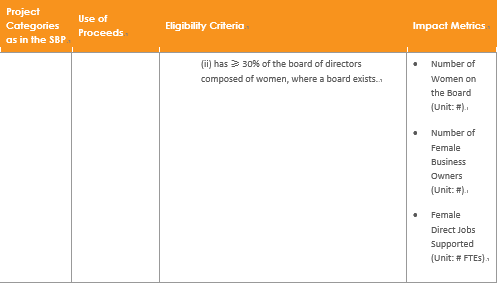

3. USE OF PROCEEDS

Haier Leasing will use an amount equal of the net proceeds from the Social Bonds to finance or refinance eligible social projects and assets selected from Haier Leasing’s portfolio.

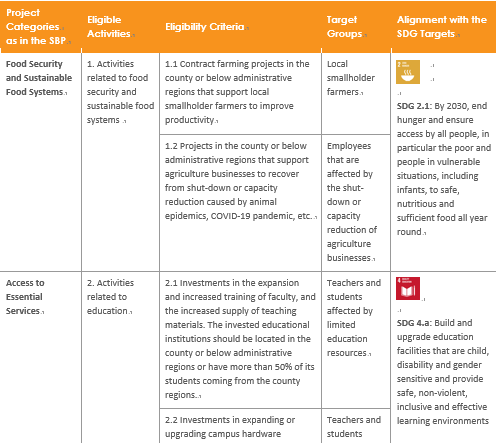

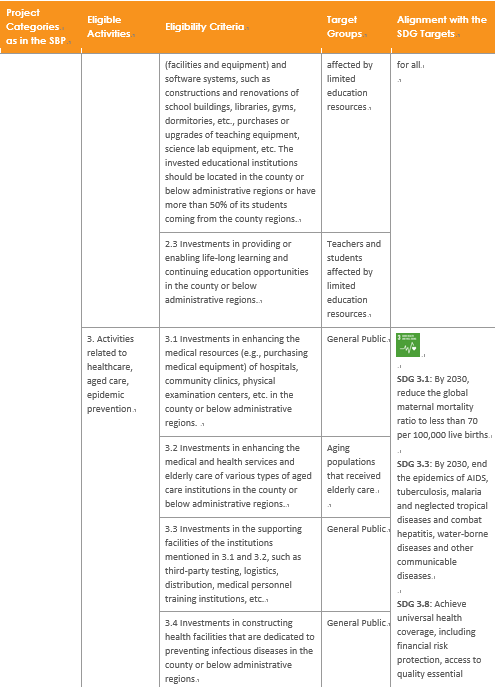

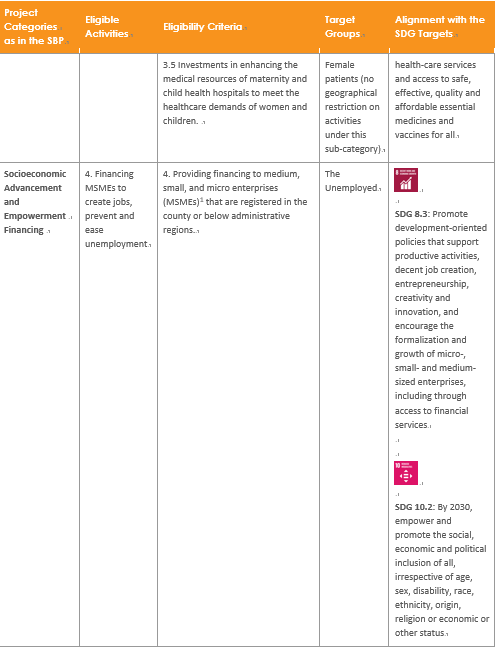

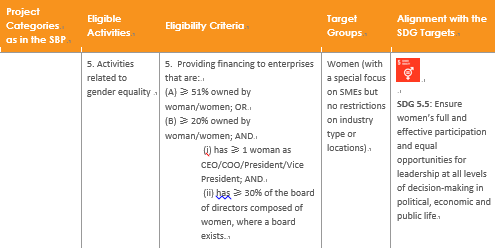

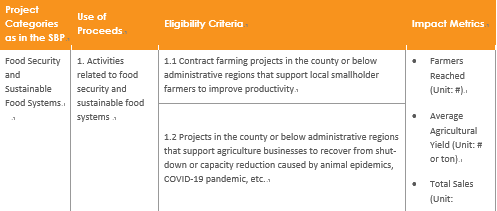

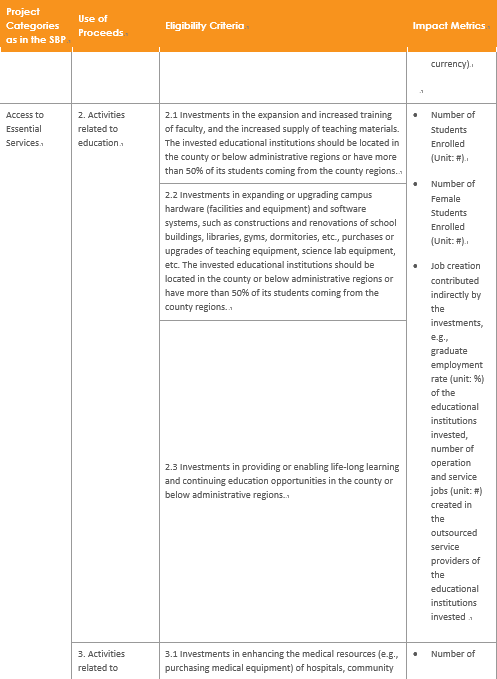

As mentioned above, the Company is focusing on increasing its social impacts in China’s county regions. As such, all proceeds, except those targeting women, will be allocated to eligible social projects in China’s county regions, or in other words, all eligible projects and target groups (except women) will be in regions at the county level (including county-level cities) or below. The detailed eligibility criteria are set out below:

4. PROCESS FOR PROJECT EVALUATION AND SELECTION

The Company will set up a dedicated Social Bond Working Group (“Working Group”) at the company level, which will be led and managed by the senior management of the Company and comprises representatives of Strategy Development, MSME Finance, Agriculture & Food, Education & Culture, Medical & Healthcare, Risk Management and Financial Market Department. The members of the Working Group will be adjusted per business needs and may include new members and external specialists at any time.

The Working Group will meet regularly to:

- Review all proposed Eligible Social Assets to determine their compliance with this Framework for approval as “Eligible Social Asset”.

- Integrate ESG management and impact management into the process for project evaluation and selection, for effectively identifying and mitigating adverse environment and social risks as well as tracking and managing its impact data through pre-set impact indicators linked to the UN SDGs.

- Manage the eligible social portfolio so long as the Social Bond is outstanding to ensure the proceeds are used for eligible projects only.

- Monitor the development of the social bond market in general and update this framework and the eligibility criteria herein accordingly.

- Document the evaluation and selection process of eligible projects to make the process available for external review (if needed).

5. MANAGEMENT OF PROCEEDS

A separate register will be set up to track the proceeds of the Social Bond. The proceeds will be transferred to a general account and be tracked through an official internal process to ensure the funds raised are allocated to eligible projects.

The Company commits to achieve full allocation within 6 months from the date of issuance.

The unallocated proceeds could be temporarily used in money market instruments with good credit rating and market liquidity until they are allocated to eligible social projects. The unallocated proceeds shall not be invested in highly polluting or energy-intensive projects.

6. REPORTING

6.1 Allocation Reporting

On an annual basis and on a timely basis in the case of material developments, Haier Leasing will prepare and make publicly available a social bond report (“Report”) disclosing the total qualifying amount of Eligible Social Projects, subject to any applicable confidentiality obligations and any other-disclosure obligations. The Report will provide information on the amounts allocated to the various eligible projects and the unallocated amount. Subject to confidentiality disclosures, the Company will provide examples of eligible projects in the Report.

6.2 Impact Reporting

On an annual basis and on a timely basis in the case of material developments, Haier Leasing will disclose the anticipated or estimated social impact of the Eligible Social Projects according to the Social Bond Framework, subject to any applicable confidentiality obligations and any other-disclosure obligations.

Where available, impact metrics will be reported and may include the following:

7. EXTERNAL REVIEW

7.1 Second-Party Opinion

The Company has appointed the independent second-party opinion provider Sustainalytics to review the Social Bond Framework. The second-party opinion will be published on the Company’s official website.

7.2 External Verification

Within one year of issuance and on an annual basis until maturity of the bonds, the Company may request a review of the Eligible Social Projects and their compliance with the eligibility criteria set forth in this Framework, to be provided by a consultant with recognized social expertise.

DISCLAIMER

The information and opinions contained in this Social Bond Framework are provided as at the date of this document and are subject to change without notice. The Company does not assume any responsibility or obligation to update or revise any such statements, regardless of whether those statements are affected by the results of new information, future events, or otherwise.

This Social Bond Framework is provided for information purposes only and does not constitute, or form part of, any offer or invitation to underwrite, subscribe for, or otherwise acquire or dispose of, or any solicitation of any offer to underwrite, subscribe for, or otherwise acquire or dispose of, any debt or other securities("securities") of the Company and is not intended to provide the basis for any credit or any other third party evaluation of securities. If any such offer or invitation is made, it will be done so pursuant to separate and distinct documentation in the form of a prospectus, offering circular or other equivalent documents (a "prospectus") and any decision to purchase or subscribe for any securities pursuant to such offer or invitation should be made solely on the basis of such prospectus and not these materials.

This material should not be considered as a recommendation that any investor should subscribe for or purchase any securities. Any person who subsequently acquires securities must rely solely on the final prospectus published by the Company in connection with such securities, on the basis of which alone purchases of or subscription for such securities should be made. In particular, investors should pay special attention to any sections of the final prospectus describing any risk factors. The merits or suitability of any securities or any transaction described in these materials to a particular person’s situation should be independently determined by such person. Any such determination should involve, inter alia, an assessment of the legal, tax, accounting, regulatory, financial, credit, and other related aspects of the securities or such transaction. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This Social Bond Framework may contain projections and forward-looking statements. Any such forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the Company’s actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Any such forward-looking statements will be based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which the Company will operate in the future.

Further, any forward-looking statements will be based upon assumptions of future events which may not prove to be accurate. Any such forward-looking statements in these materials will speak only as at the date of these materials and the Company assumes no obligation to update or provide any additional information in relation to such forward-looking statements.